Diversification remains key to investors

Friday 15th July 2022

Katy Baxter

People who hold investment portfolios are currently experiencing an extended period of volatility and it is highly likely that the value of their portfolio has reduced since the end of 2021. Primarily the reasons behind this are the supply chain problems post COVID and the war in Ukraine, both of which have led to an increase in inflation, the raising of interest rates and the ongoing worry of the major economies of the world falling into recession.

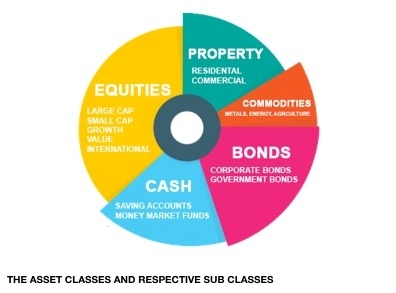

Now more than ever there is a need for investment portfolios to be well diversified and in line with a client’s appetite for risk, which is why at Montgomery Estate Planning we favour Multi-Asset and Multi-Manager funds. Multi-Asset funds typically include a wide range of equities, bonds, property, cash, and other types of investment, in one fund to make your investment portfolio as diverse as possible. If one of the asset classes does not perform well, only a part of your portfolio is affected. Using Multi-Asset funds can be less risky than trying to build and maintain a bespoke portfolio of funds, and is run by an expert fund manager which over time will normally deliver smoother returns compared to combining a portfolio of single strategy funds.

At Montgomery Estate Planning we use our Core Fund Filter System™ to select funds which are risk targeted and are managed to stay within a client’s defined risk rating. Within the fund, the manager will be regularly rebalancing the underlying assets to maintain the risk rating, but all of this is done without incurring any Capital Gains Tax (CGT) for clients. This is in stark contrast to portfolios with a variety of individual funds, which need to be rebalanced and potentially give rise to CGT problems if held in a General Investment Account.

The Multi-Asset funds on our Montgomery Core List panel are designed to give our clients increased diversification of underlying funds within a portfolio. These fund managers select individual funds from other fund houses in recognition of the fact that they cannot be experts in everything themselves. Bringing a collection of funds together, within one Multi-Asset fund, creates a well-diversified portfolio of assets. Most importantly, this well-diversified portfolio of assets can quickly adapt to reflect the fund managers attitude to changing market conditions. As an investor in times of market turbulence, this gives a high degree of comfort that your portfolio reflects on a day-to-day basis, the most up-to-date combination of asset classes and funds.

2022 is proving to be a challenging year for investors, whether you are accumulating wealth or having to draw an income. Now, more than ever, the best place to be is in a diversified portfolio that is managed to your personal risk profile and aims to meet your long-term financial objectives. No one knows how long this volatility will last and what the future holds, but experience from previous political and economic shocks has shown us that over time a well-diversified portfolio will generate positive returns for those clients who remain invested.

As always if you are concerned and would like to discuss any aspects of our approach, or are a client and want to talk about your portfolio please get in touch.