Inspiring art and classical music for school pupils

Monday 3rd March 2025

Katy Baxter

An innovative project running on the Isle of Wight, UK that brings together famous paintings from the 19th and 20th centuries with emotive pieces of classical music by some of the world’s greatest artists and composers has been sponsored by Montgomery Estate Planning. The project concept was developed by Professor Robin McInnes OBE to counter a trend imposed on school curriculums which diverted attention and funding away from the arts and music towards maths and science; this despite the widely recognised educational, health and well-being benefits that arise from studying art and participating in music activities as part of a rounded education. Comprising a thirty minute inter-active video that matches great artworks, each of which tell a story, accompanied…

Market and economic outlook for 2025

Wednesday 26th February 2025

Katy Baxter

2025 is already proving to be a busy year in terms of geopolitics and the world appears to be going through more change. It’s sometimes difficult to see what impact these changes will have on investments so we thought it would be good to share a document written by Vanguard that explains the outlook for markets and the economy as 2025 unfolds. As we know it’s impossible to predict the future but having an insight from one of the world’s leading investment businesses can help filter out the noise and focus on what really matters. If you would like to read the article then please click here.

What does diversification mean?

Tuesday 15th October 2024

Katy Baxter

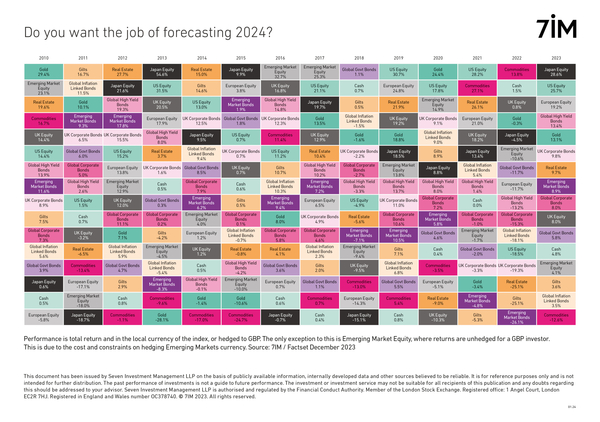

Having a well diversified portfolio of investments is a phrase often heard when talking about the need to reduce the risk of directly holding stocks and shares. This is a sentiment we absolutely agree with. History shows us that picking ‘winners' year after year is almost impossible – if it was possible we would all be multi-millionaires many times over! Today many advisory firms create portfolios for clients using a range of different funds and asset classes, from fixed income, cash, stocks, property and alternative assets, in an attempt to reduce risk and generate good returns for clients. These funds need regular rebalancing to keep the asset allocation and exposure to risk consistent, and this requires the regular…

The need to have a diversified portfolio

Thursday 25th January 2024

Katy Baxter

I have long recommended the need for clients to have a well diversified portfolio of investments. Although the last couple of years have had specific geo-political and economic challenges they have certainly not been unique and a look back in history shows how different assets perform in different years. The image shows how each asset class has performed over the last 13 years. It is such a striking image and as they say a picture paints a thousand words. Forecasting is pretty much impossible and the case for diversification cannot be made any stronger. Please click here to view for a bigger view but if you would like a PDF copy of the image please email me. At Montgomery Estate Planning…

Inheritance Tax receipts at record levels

Wednesday 10th January 2024

Katy Baxter

Inheritance Tax continues to be a political hot potato with some commentators predicting it might be reduced or eliminated by the present Chancellor. One thing is for sure – current rates of revenue continue to raise funds for the government to increasing record levels. In the eight months from April to November 2023 data from HM Revenue and Customs showed receipts had totalled £5.2billion. This is a significant amount of income for HMRC and so it’s quite hard to imagine this will be cast aside, and with a potential change in government coming this year I would not expect Sir Keir Starmer and Rachel Reeves to be abandoning this valuable source of tax revenue. Currently 4%, or 1 in…

Quarter 3 (2023) update

Tuesday 21st November 2023

Katy Baxter

As we bid farewell to the third quarter of 2023, let’s delve into the financial landscape of the United Kingdom and other countries to explore the key economic developments that have shaped the past three months. There is still a certain amount of volatility in the markets and indices rise and fall almost on a daily basis. Keeping focused on a diversified portfolio of funds over the longer term is without doubt the right way to weather the uncertainties. Katy Baxter Financial market background The main equity regions had a mixed performance over Q3. UK equities rose over the quarter as companies were helped by sterling weakening in comparison with the US dollar and energy companies benefitting from a recovery…

Winners of U25 Trophy at Cowes Week 2023

Monday 7th August 2023

Katy Baxter

We are proud to have sponsored the young sailors competing for the Under 25 Trophy at Cowes Week 2023, one of the UK's longest running and most successful sporting events. The Montgomery Estate Planning Under 25 Trophy was presented to the highest placed Under 25 Crew: Charlie, Harry and Tom White. The Triplets from Wootton, sailing in the Squib class, were extremely proud to have won again in ‘Kestrel’. Great sailing against tough competition and weather conditions allowed the IoW based Triplets to retain their 2022 title, another first for the trophy winners. We are also pleased to have been part of the presentation for the Cowes Week Youth Trophy which was presented to Christopher-Joel Frederick, who is a leading…

Record Inheritance tax collected

Thursday 27th July 2023

Katy Baxter

The first quarter of the 2023/24 financial year saw £2bn collected by the Treasury in Inheritance Tax (IHT). The latest figures follow a record-breaking year in 2022/23, which saw a total of £7.1bn raised in IHT. The latest quarter has raised 11% more than the same period last year, which exceeds the previous peak of £1.8bn in Q3 2022/23. In June 2023 tax receipts recorded an income of £795m, which marks a monthly all-time high. The Office for Budget Responsibility (OBR) has estimated that IHT will raise £7.2bn in the 2023/24 financial year, with as much as £8.4bn by 2027/28. However, there has been recent media speculation that the Government is considering scrapping the tax ahead of the next general election…

Proud to be sponsoring U25 Trophy at Cowes Week 2023

Tuesday 6th June 2023

Katy Baxter

We are proud to be sponsoring the young sailors competing for the Under 25 Trophy at Cowes Week. We will be supporting them, their families and friends during one of the UK’s longest running and most successful sporting events on Wednesday 2nd August 2023. The Montgomery Estate Planning Under 25 Trophy will be presented to the highest placed Under 25 Crew at the Prize Giving on Friday 4th August. Cowes Week has always been popular for young competitors as it provides them with a perfect opportunity to realise their talent and helps to encourage our future sailing stars. Competing for the U25 Trophy gives the most amazing platform for them to compete on equal terms with sailors of all ages and…

Sustainable and Responsible (ESG) investment funds – what’s really under the bonnet?

Thursday 1st June 2023

Katy Baxter

There’s much talk these days about ESG in the investment world and as a new advisory business we wanted to be able to offer our clients a range of ESG funds when building their investment portfolios. We know that some clients have strong views on how their investments make the world a better place and this is borne out by recent figures which show that in 2022, UK investments in ESG funds reached a record £91 billion which was up from £56 billion two years earlier. So what do each of these factors actually mean: Environmental factors Natural world factors and the biosphere. Includes the interaction and use of renewable and non-renewable resources (ecosystems, biodiversity, water, minerals) Examples of this are climate change,…

Katy's outlook for UK inflation and interest rates

Tuesday 11th April 2023

Katy Baxter

With UK inflation higher than expected and interest rates now at 4.25% what’s ahead? The Bank of England’s latest 0.25% increase to UK interest rates takes them to 4.25%. Many hope it will be the last hike of the year but with inflationary pressures persisting, Ian our Chief Operating Officer asked Katy for her outlook on inflation and interest rates. Were you surprised Katy by the BoE’s decision? Not really Ian, although 2 out of the 9 members of the Monetary Policy Committee didn’t want to increase rates. Whilst the collapse of Silicon Valley Bank and concerns over Credit Suisse caused some more volatility in the markets, the impact on the UK banking system was limited. The…

Some good deals ahead.....

Wednesday 1st February 2023

Katy Baxter

It’s been nearly two years since the Ever Given container ship blocked the Suez canal semi-paralysing the global shipping supply chain. Even worse, at the time the Ever Given was ploughing into the desert, ports around the world had ships anchoring for weeks before lockdown-hit docks could unload them. People and businesses wanted goods, but they were stuck at sea. Packed into containers floating off the coast, or slogging around the continent of Africa to avoid the Suez Canal traffic jam. That had a major impact in pushing up prices of imports over the past couple of years. Why? Because 90% of all traded goods travel by sea! 11 billion tons of goods, worth $14 trillion per year. Clogging that up creates…